Issue: Vol 169, Issue 4352

3 May 2012

What steps show an arrangement is caught by disguised remuneration rules? IAIN ROBERTSON explains

KEITH M GORDON asks a P35 service company question and gets a reply worthy of Captain Mainwaring

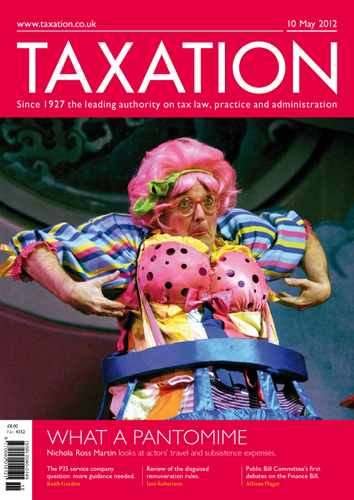

NICHOLA ROSS MARTIN ponders whether actors are itinerant workers

The first four sittings of the Public Bill Committee’s debates on the Finance (No 4) Bill are reported by ALLISON PLAGER

A property originally owned by a grandmother was left to the client’s father and his sisters and then to the client and his sister. The client’s aunts were allowed to live in the property for as long...

A, B and C are sisters and partners in an LLP investing in residential property. A lived in one of the properties for a year

The owner of a flat in the UK let this out before going to work abroad 25 years ago. Income has been declared correctly each tax year. The client intends to return to the UK and reoccupy the flat for...

A Portuguese company owns land in Portugal on which it has built a villa. Some time ago, the company’s domicile was changed to Malta for tax reasons, although UK corporation tax returns are submitted...

Selling debts; Corporate partner; Pension compensation; Virtual remuneration

'OTS must keep on top of small business issues'

'HMRC are shifting cost and responsibility to taxpayers and agents'

IHT, VAT, SDLT, International; NI; capital gains; Lloyds

Toolkits updated; VAT notes; ISA Bulletin 43; Skipton Fund; P35 deadline

Tax credits deadline is 31 July

'Taxpayers considering judicial review must act as a matter of urgency'

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES