Issue: Vol 169, Issue 4346

15 Mar 2012

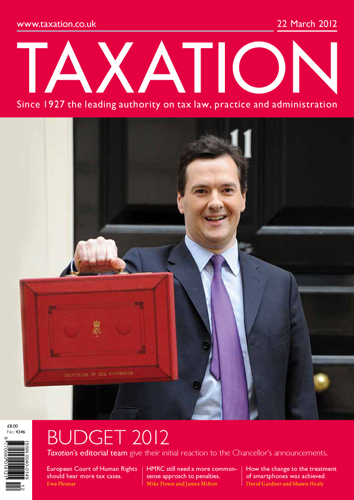

MIKE TRUMAN, RICHARD CURTIS and ALLISON PLAGER give their initial responses to the tax measures in George Osborne's 2012 Budget

DAVID GARDNER and SHAWN HEALY describe how the Revenue was persuaded to change position on web-friendly mobiles

MIKE DOWN and JAMES MILTON review the inaccuracy penalty regime and ask whether it is behaving as anticipated

EWA PLESNAR explains why tax should be fully covered by Article 6 of the ECHR

A father, who trades in partnership with his son, gave his main residence to his offspring with the apparent aim of protecting the property from possible future care-home charges. Some rent for the...

A VAT-registered property development partnership is buying land for residential use, which has previously been subject to an election to charge VAT

To reduce his company’s borrowings, the principal director/shareholder has raised £500,000 secured on his home and has lent this to the company

Following her marriage, the director/shareholder of a company reduced both its activities and her remuneration

Splitting shares; Salesforce VAT; Proper PAYE; Use your loaf

Update with fixes and improvements

HMRC datalab; Vilnius exchange; Annual allowance; Contracting out; High-tech team

New regs come into force next month

Transfer to new scheme will avoid charges

Deadline approaches for non-gift aid organisations

No need to change declaration wording immediately

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES