Issue: Vol 168, Issue 4316

5 Aug 2011

HEATHER MILLER investigates the rather scary subject of assignments, grants and premiums

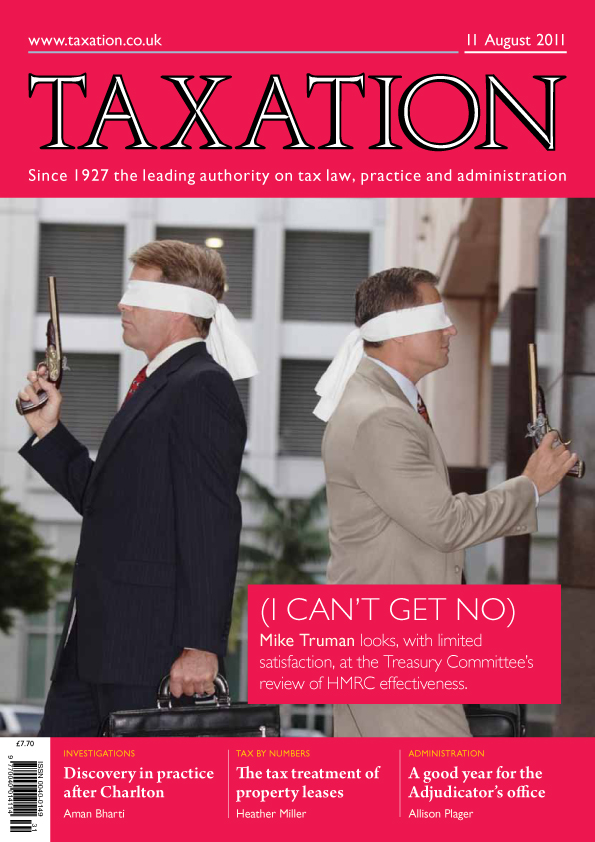

MIKE TRUMAN wants satisfaction from the Revenue for its staff, taxpayers and agents

AMAN BHARTI gives an inside view of the Charlton case

Why is the Adjudicator so happy? ALLISON PLAGER finds out

A mother and father appear to have transferred a block of eight flats into the joint names of themselves and their two adult children, but pay a rent in respect of one of the flats that they occupy

...

The director of a property broking company is to buy a public house and convert this into a residence for his own use

The shares of a non-office holding minority shareholder in a family company are to be purchased from him by the other family member shareholders, but concerns are raised as to valuation and disclosure

A common current tax planning arrangement appears to be the insertion of a limited company into a partnership to shelter profits from high personal rates of tax, but what happens next?

NI and EU; Failed fees; OAP underpayment; We was robbed

Calculations for 2010/11 being issued

Enterprise zones; Plumbers’ plan; Childcare; Tax treaties

Clarification on exemption in TCGA 1992, Sch 7AC

Bank of England no longer be available for use

HMRC explanation follows Astra Zeneca judgment

RCB explains consequences of payment scheme

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES