Issue: Vol 175, Issue 4483

6 Jan 2015Impending changes to capital gains relief for only or main residence

Why a mixed partnership failed to claim the AIA

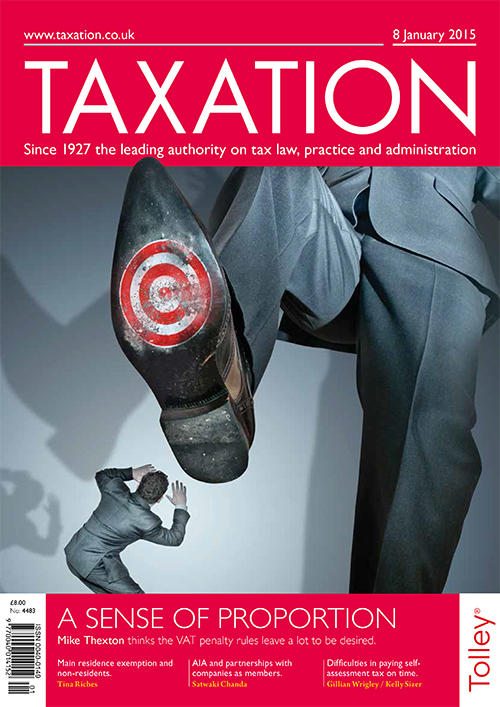

Does the VAT default surcharge regime achieve its purpose?

How to help clients who struggle to settle their self assessment bills

Items that can be treated as fixed plant

VAT liability relating to staff working abroad

Tax-efficient payment of dividends from a Cuban subsidiary to UK parent company

Goodwill Inc; Isle of Man; Protective gear; Cricket catering

Top-slicing relief calculation for a chargeable event gain

Self assessment forums

HMRC will hold open chat forums in January in January to answer questions about self assessment. Dates for the online events can be found on GOV.UK...

HMRC have introduced a new online payment service for taxpayers who wish to settle their self assessment and VAT bills by debit or credit card.

The system was launched by the department in beta mode...

Secondary legislation is set to simplify PAYE regulations from 6 March 2015. The change will remove the requirement for employers to complete the end-of-year checklist when making their final full...

A tax agent who lied to cover up incorrect returns submitted for clients has been convicted of six offences, under the Fraud Act after an investigation by HMRC.

Christopher Jonathan Lunn who worked at...

T Lynch (TC4177)

General Healthcare Group (TC4176)

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES