Issue: Vol 173, Issue 4440

20 Feb 2014Assessing a new standard for ethical behaviour in tax

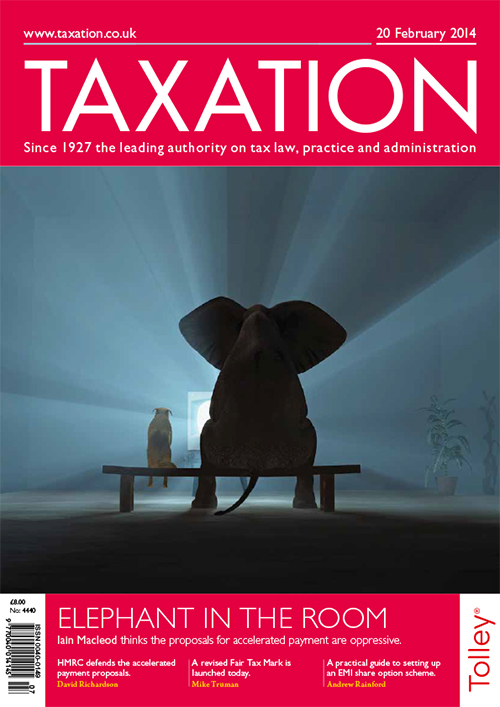

There are better ways to tackle avoidance than those recently proposed by HMRC

The rationale behind the Revenue’s plans to collect tax upfront in some instances

Step-by-step guide to setting up an enterprise management incentive plan

Crowded IT company; Happy couple; Helping house; Doggy day care

To mitigate income tax liability, a client transferred commercial property into the joint names of himself and his wife. However, only his share is eligible to capital gains tax entrepreneurs’ relief

...

A school wishes to improve security and intends to build a house in the grounds, which will provide accommodation for the caretaker. It seems likely the separate disposal of the building from the rest...

A UK resident acquired a portfolio of commercial properties from his uncle in 2011. The uncle did not claim any capital allowances in respect of the properties

A UK taxpayer owns US Treasury bills issued at a discount and redeemed at their full value in less than a year. No interest is paid

HMRC have launched a helpline dedicated to tax problems as a result of the current flooding around the UK.

The service – which aims to provide fast and practical advice – is available on 0800 904 7900...

Share incentive plans (SIPs) and save-as-you-earn (SAYEs) schemes will see higher limits from 6 April.

The maximum value of free shares that can be awarded in a SIP will rise from £3,000 to £3,600 a...

Walk-in advice services for taxpayers will be withdrawn in May with the closure of the HMRC’s network of enquiry centres. They will be replaced by a telephone service, the tax authority has...

The penalties regime of the real-time information (RTI) reporting of PAYE will not begin October, HMRC have announced, signalling a six-month postponement.

Automatic fines for late filing and overdue...

HMRC tackled record levels of online fraud in the run-up to last month’s self assessment deadline, the department has revealed.

Taxpayers reported 23,247 incidents of phishing o the Revenue during the...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES