Issue : Vol 189, Issue 4834

29 Mar 2022

Taxation Awards shortlist revealed...

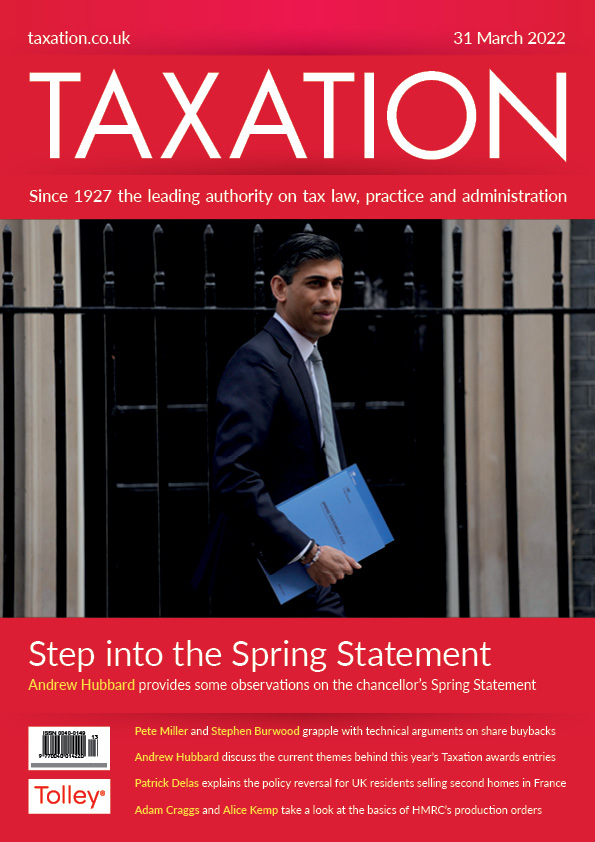

Step into the Spring Statement

Differing views

Overcoming adversity

The skinny on production orders

Correspondence from readers on a Readers’ forum query concerning professional indemnity insurance and the time it took for HMRC to respond to a letter reporting a gain on a life assurance...

Mortgage penalties

Payment in lieu of notice

Transfer of a going concern

Company conundrum

Company profits to directors’ personal service companies.

My client, Mr X is the director and majority shareholder of Company A. His wife is a minority shareholder. Most of...

From 7 May 2022, taxpayers will have to make postal claims on the revised P87 form for income tax relief on employment expenses. HMRC will reject claims that are made on substitute forms which have...

From 31 March 2022, new clients will need to use a new form 64-8 to give the agent authorisation to deal directly with HMRC on their behalf. Existing clients do not need to re-authorise their current...

Spotlight 59 updates HMRC’s position on avoidance schemes that attempt to treat payments made by an employer to an employee on the maturity of a contract for difference as a capital gain rather...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES