Issue: Vol 178, issue 4565

30 Aug 2016Is this business a trade or furnished holiday accommodation?

Are you now, or have you ever been…?

Practitioners may learn from recent cases on deliberate errors.

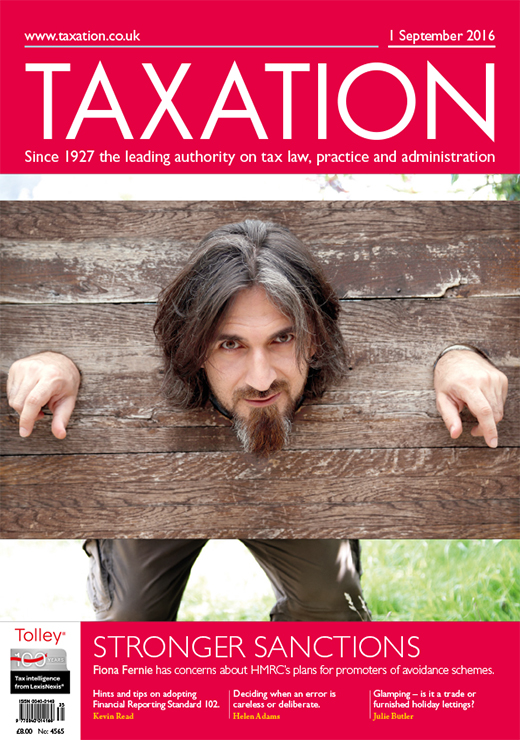

HMRC’s plans to strengthen tax avoidance sanctions and deterrents.

Adopting FRS 102 may prove to be taxing.

Recouping tax charges of overpayment on pension.

Allocation of rent between commercial and residential property for VAT.

Correspondence from readers on topical subjects.

A non-domiciled taxpayer wishes to start remitting overseas income to the UK.

Allowances unclaimed; Busted; Trust start date; Tax but no invoices

Can tax relief be obtained for preparatory costs if trading does not proceed?

Gift-aided donation.

Employer Bulletin 61.

Dates for October.

Tackling Disguised Remuneration.

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES