Issue: Vol 174, Issue 4464

12 Aug 2014HMRC need to rethink their policy on film tax schemes

The latest consultation on calculating charges could be the final nail in the coffin

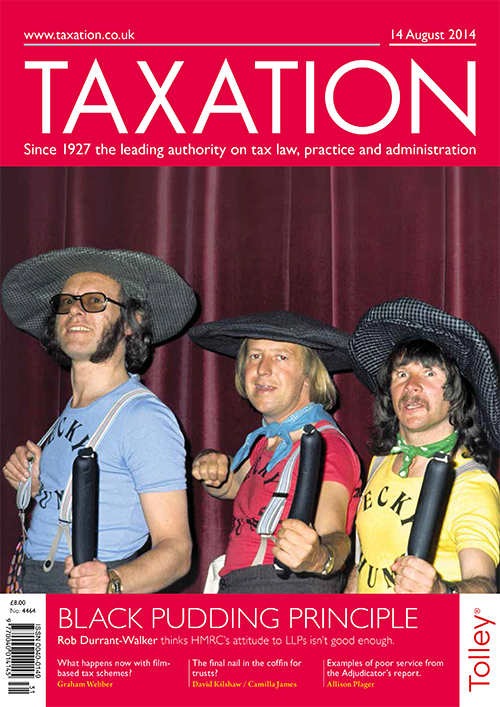

Ecky thump! Does the Revenue take inspiration from The Goodies in its approach to LLPs?

A look through the adjudicator’s 2014 report on the taxman’s handling of complaints

IHT and a PSC; PO foxed; Hoof and home; Coffee pot

Minimising VAT on the purchase of a mobile building for educational purposes

Should class 1A contributions be refunded when benefits are made good?

Tax consequences of the deferred payment of loan interest or rent

Can letting relief apply if main residence has been claimed on another property?

CIOT warns of “extensive battles” over interpretation of law

M Turullols (TC3795)

G and M Rockall (TC3767)

Download the exclusive Xero

free report here.