Issue: Vol 172, Issue 4424

17 Oct 2013The conflicting demands of the Data Protection Act and its taxes counterparts

HMRC are hitting amateur clubs for six over employment status

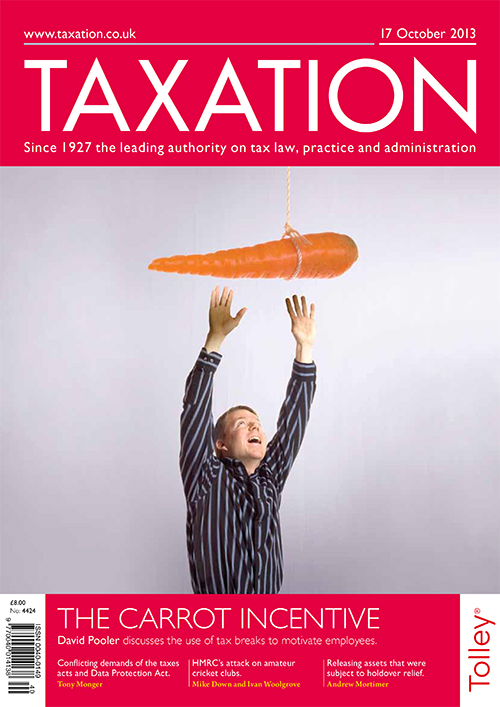

Tax-advantageous ways to motivate employees of growing businesses

When trustees are safe to release assets subject to a capital gains tax holdover election

A one-man limited company made a substantial donation to Better Together, the organisation promoting the continuation of the UK. Is this allowable as a deduction in the company accounts?

...Birthday boy; Favoured buyer

A client purchased new business premises and claimed rollover relief. HMRC contend that the claim fails because the business activities contain an element of horse racing

Employers have themselves to blame for the majority of PAYE bills they dispute, according to a report from HMRC.

Changes to the code of practice on taxation for banks are set for Finance Bill 2014, following a consultation on strengthening regime

The key changes:

Download the exclusive Xero

free report here.