Issue: Vol 171, Issue 4401

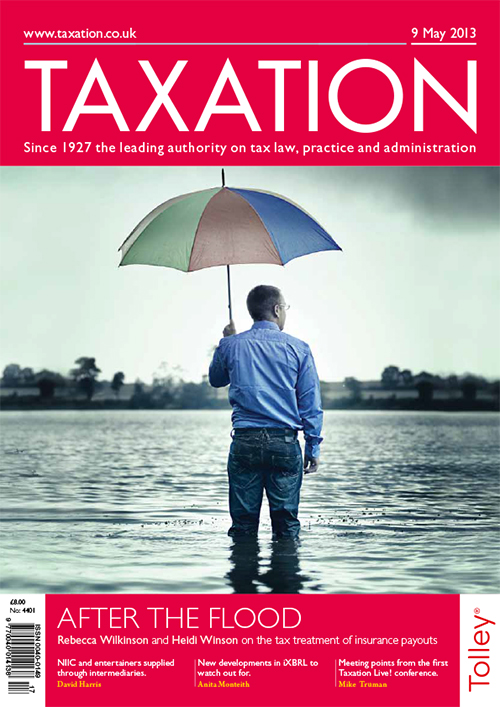

9 May 2013Even disasters have tax consequences: the implications of insurance receipts

Looking forward to the next few years of online filing with iXBRL

Speculating about another enterprising move by HMRC to maximise income from Class 1 National Insurance contributions

Highlights from the event held in London on 25 April

Highlights from the event held in London on 25 April

A non-domiciled UK resident was claiming the remittance basis and paying the annual charge, but died in December 2012. His widow has received a UK pension scheme lump sum

...Transfer and sale; Sewerage farm

...stock exchange; ISA Bulletin; investment trusts

British overseas territories with significant financial centres have signed up to the government’s strategy to create global tax transparency.

Employers still expected to meet May deadline

Download the exclusive Xero

free report here.