Issue: Vol 170, Issue 4361

5 Jul 2012

PAUL APLIN is at a loss to understand the reasoning behind plans to cap tax reliefs

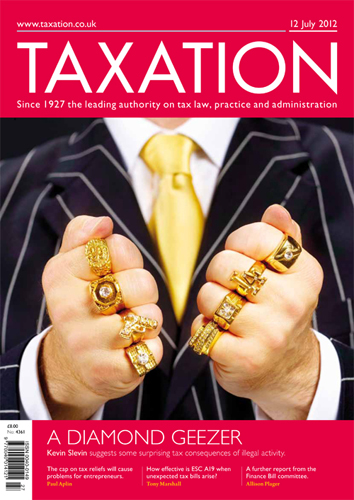

Illegal activities may result in a taxable profit, but are associated expenses allowable? KEVIN SLEVIN investigates

Is is possible to make an ESC A19 claim stick, wonders TONY MARSHALL

ALLISON PLAGER covers the 11th and 12th sittings of the Public Bill Committee’s debates on the Finance Bill

A limited company is based in, and operates in, the UK and employs about 40 people. It has won an order to carry out work in the Far East and advice is required on how this new business is structured

A self-employed client was 65 years old earlier this year and was advised by HMRC to cease payment of Class 2 National Insurance contributions at that point, but was this right?

A British citizen has been living in France for the past 20 years, but is now returning to the UK. He is selling the property which has been his only and main residence in France, and which is owned...

A tax practitioner will shortly be seeing a potential new client who works abroad on a cruise ship and general information is required regarding the possible tax implications

De minimis?; On a roll; Sheltered gain; Mobile home

Fuel duty; Employer guide; Tax dashboard; VAT notices

Scottish pubs and nightclubs are targetted

New land and buildings transaction levy from April 2015

Revenue explains action for authorising an adviser

People expected to have knowledge of own tax affairs

Late self-assessment filing will lead to only limited penalties

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES