Issue: Vol 169, Issue 4347

23 Mar 2012

MIKE TRUMAN explains the proposals for simplifying small business taxation

NEIL WARREN celebrates a decade of the VAT flat-rate scheme by looking at unlikely opportunities to claim input tax

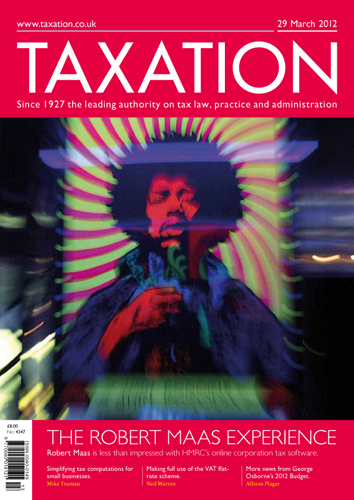

In which the author takes a trip with HMRC’s free, online, corporation tax-filing software

Highlights from the TIINs and other documents, presented by ALLISON PLAGER

A trader has been using the VAT flat rate scheme since 2007, but it has now come to light that he did not formally register to use it. Does this mean he will have to recalculate the VAT liability?

The rules on the single farm payment are due to change in a few years time and the rules in Wales may also differ from those in England. How will this affect a situation where a farming trade has been...

A sole practitioner dentist operated his practice from premises in two towns about ten miles apart. One practice has been sold, although the premises have been retained, but HMRC have refused a claim...

A UK resident and domiciled taxpayer has interests (less than 5%) in some Delaware limited liability companies. If these are disposed of will there be an entitlement to entrepreneurs’ relief?

20 years ago today; Shine a light; Railway to Welwyn; Scrap income

Copy letter to HM Revenue & Customs, 100 Parliament St, London

'Reasonable' for taxman to require access to emails and telephone records

Easter break; RPI; UK/Swiss protocol; Renovation relief; Household costs; VAT online

Consultation on draft guidance

Change to allow for partial refund without unauthorised payment charges

HMRC to charge fixed costs

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES