Issue: Vol 168, Issue 4325

7 Oct 2011

MIKE TRUMAN summarises your responses to HMRC's tax agents strategy consultation

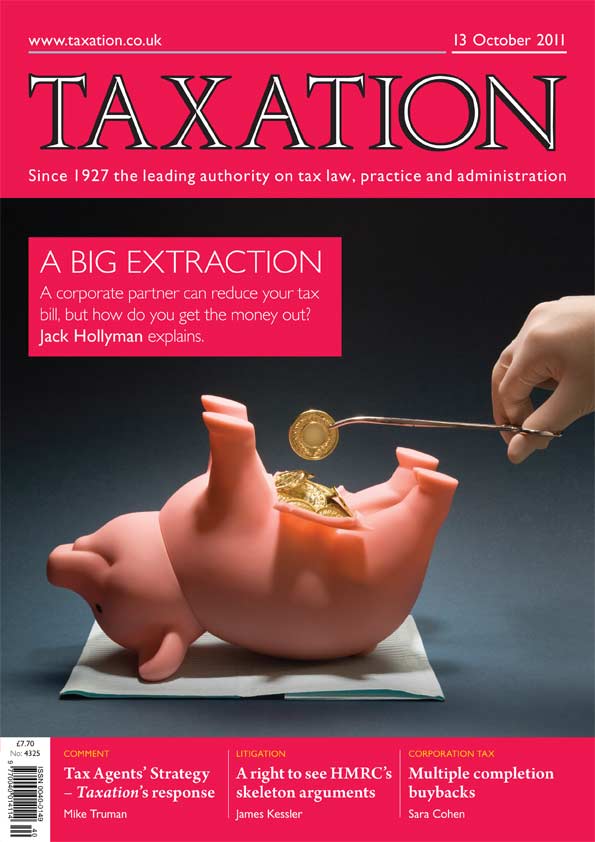

JACK HOLLYMAN considers various ways of mining profits from a corporate partner

HMRC skeleton arguments are a valuable resource and should be available to the public. JAMES KESSLER QC explains why

SARA COHEN considers a route to private company share buybacks

The amount of actual business profits can differ from the amount that is subject to tax, but how does this work for the beneficiary of a trust?

PAYE code number BR was operated in respect of a taxpayer’s secondary employment, but this did not collect the higher-rate tax liability

A charity exhibits old aeroplanes and also uses them for flying displays. It intends to import a WW2 plane from the USA

A corporate partner can be an effective tax planning device for the self-employed...

Will trust; Cash challenge; An attorney’s power; Chill-out room

'Stamp duty land tax not taken into account'

'If you didn’t ask you didn’t get'

'Too much emphasis placed on the business owning the asset'

EIS approval; Agent copies; Overseas expenses; PAYE due date

Four more sites will be added from January 2012

HMRC launch tax catch-up plan

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES