Key points

- Simplification of the tax system was mooted in the 2015 spring Budget.

- Pros and cons of moving the tax year end to 31 March or 31 December.

- Combining a different tax year end with making tax digital.

- Reforming basis periods is likely to cause the most work for businesses.

To understand the current tax simplification proposals we need to go back to the 2015 spring Budget when ‘making tax easier’ was first announced (Budget Red Book s1.108 – tinyurl.com/spr15s1108). The government originally envisaged that 10 million individuals and 5 million businesses would have digital accounts by early 2016 and that, by 2020, information would be transmitted digitally removing the need for tax returns. The plan was to ‘reduce the administrative burden on taxpayers who currently complete an annual tax return’.

The initial project comprised two elements:

- the personal tax account for all individual taxpayers – which is now in existence and is used in a variety of ways, not just for tax; and

- new record-keeping and filing requirements for the self-employed and landlords.

Self-employed individuals and landlords would be required to keep their business records digitally and upload summary data to HMRC every quarter using software, followed by their self-assessment tax return. This has now been superseded by a final declaration.

After receiving evidence in 2018 from the digital advisory group, agents, ICAEW and Office for Tax Simplification (OTS) that many taxpayers would not be ready for such a change, along with an update that software providers would not have the software ready, digitalisation introduction was delayed. The government decided to introduce making tax digital for VAT first from 1 April 2019 and this has been formally evaluated so that adjustments to the making tax digital (tax) platform could be made (tinyurl.com/hmrcmtdevmar20).

Moving forward, in its 2020 Budget, the UK government set out its thoughts on the modernisation of the UK tax system over the next ten years as being, ‘a vision for a fully digital tax system which is better able to support the emerging needs of taxpayers, which is fair and even-handed and builds trust over time, and which works closer to real time, so that people can pay the right tax with ease while they work, live their lives, and run their businesses’.

To achieve this, there have been several recent proposals as discussed below.

Fiscal year end

The document provided by the OTS (Potential for moving the end of the tax year – Scoping document) in respect of a change of tax year end covered two specific dates, 31 March and 31 December (tinyurl.com/otsppendtaxyr).

31 March

This date was chosen as it is both the end of a quarter and the nearest month end to the current tax year. It is also the date to which the UK government makes up its own accounts, and by reference to which corporation tax rates apply. The change would result in a difference of five days.

A change in the tax year from 5 April to 31 March would have minimal to no effect. In practical terms it is accepted that from a business tax viewpoint, both dates are essentially one and the same. Changing the tax year from 5 April to 31 March would affect only those forms of income and gains that are based on the receipt or the transaction date. Moving from 5 April to 31 March would not change a great deal, apart from removing a tax year that is an historical anachronism.

Figures used by HMRC in its basis period reform consultation suggest that 93% of sole traders and 67% of partnerships use 31 March as their year-end (tinyurl.com/hmrccondocbpref). So companies using non 31 March year ends will tend to be larger businesses and within specific sectors.

31 December

Moving the year end to 31 December would result in a shortening of the tax year by three months and five days. Many major tax regimes have a tax year end date of 31 December. Ireland, whose tax year end used to be 5 April, moved its government accounting and tax year ends to 31 December in 2002.

However, a change to 31 December would create significant advantages from a viewpoint of individuals and companies that deal with or are based in multiple jurisdictions. It is relatively common for investment reporting to be produced – outside the UK – on a calendar year basis and this can create problems when trying to report income and gains for a fiscal year to 5 April because the standard reports are not drawn up to the UK’s fiscal year. With quarterly reporting, this may change as the need to report the income on a quarterly basis becomes the norm.

The downside is that should the year end change to 31 December, during the transition year for those not currently using this date already, profits, when compared year on year, could look lower or higher and thus provide a false picture of the overall condition of the entity.

Making tax digital

With the introduction of making tax digital (MTD) for individuals from April 2023, there will be a complete shift from annual reporting to quarterly reporting. It will be the biggest change to the tax system since the introduction of self assessment for the 1996-97 tax year.

At present, it does not yet follow that there will be an acceleration of tax payments from half yearly (payments on account and balancing payments) to quarterly (and balancing payment). However, the reporting function, once fully operational, opens up the possibility of payments becoming due to match the submissions at a future date. The general direction of travel is towards reducing the gap between profits being generated and tax being paid. It would be entirely unsurprising to see a future quarterly payment system and a review has been undertaken in this area – see HMRC’s The tax administration framework: Supporting a 21st century tax system (tinyurl.com/hmrctaxadmin21).

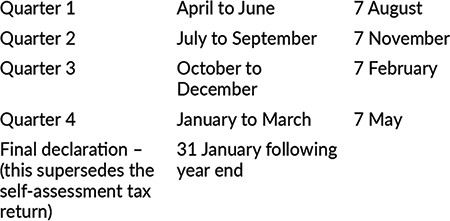

Using a 31 March year end with either a 31 March or 5 April year end, quarterly reports would be required by:

At present, the payments regime is:

- Payment on account 1 – 31 January;

- Payment on account 2 – 31 July; and

- Balancing payment – the next 31 January.

The reporting of actual figures for a period with year-end adjustments will have a major effect not only for 31 March year-ends but also for those who do not use 31 March or 5 April as their current year end. To bring the system into line with tax year reporting, the latest proposal from the government aims to address this with a basis period reform.

There is no confirmed start date for the corporate reporting regime, but it is expected that it will be before April 2030 to meet the modernisation targets. Given that it is not possible to ascertain the number of companies that do not use 31 March year end, it is difficult to quantify the impact of the change to MTD for companies. The change may prove beneficial for larger companies that already make quarterly payments, because it may provide a more accurate method of calculating these payments. This area is currently under consultation (tinyurl.com/hmrcmtdct20).

Basis periods

It is reform of basis periods that will cause additional work for businesses. HMRC figures estimate reform would cause additional work for 3% of sole traders and 15% of partnerships from April 2023. The department used the submitted tax returns information to compile their figures. It is not immediately apparent how this reconciles with the figures used by HMRC showing 93% of sole traders and 67% of partnerships using 31 March as a year end because the proposals appear to create additional compliance burdens on any business operating with a year end other than 31 March. It may be that there is a view that the change in basis period will create a nudge towards using a 31 March year end.

The consultation on proposed changes to basis periods closed on 31 August 2021 and should provide clarity in advance of the April 2023 commencement date. The current proposal seeks to end the calculation and use of overlap which will result in income being taxed at the relevant point in the tax year. A by-product will be that the choice of accounting date will be for commercial reasons only.

The consultation document also proposes that for periods after April 2023, income should be apportioned to the actual period in which it arises using the same methodology currently used for property income.

Finally, the proposal suggests that there will be a transition period of one year. It is this transition element that will cause additional complexity for those not using a 31 March year end as it will not be required for this year-end date. The reverse is that overlap calculations are no longer required on commencement nor the need to maintain a record of overlap to be used on cessation.

For those using a date other than 31 March, there will continue to be a requirement to declare income from two different accounting periods in a single tax year with a final declaration that can be much later. This will affect quarterly reporting under MTD and basis periods for individuals and will continue after the ‘spreading’ adjustment has ceased.

The current proposal could generate an additional tax liability. This is because of two elements, namely 12 months of profit to the usual accounting date plus and second, the proportion of profit to meet the tax dates for the transition year less overlap. This assumes that the overlap created in earlier periods is less than the additional profit to be taken into account. The reverse may be that a tax refund is available if the overlap is greater than the tax year profit adjustment. Overlap relief will often be less than the additional profit brought into charge, particularly for those who have been in a business for several years, however, this will require review on a case-by-case basis.

Where there is an additional charge, the proposal allows for the additional profit to be spread over five years.

The application of ‘spreading’ is not new for tax as this was done most recently for revenue recognition purposes whereby the spreading was allocated across three to six years. For MTD, the adjustment would be spread across five years.

This adjustment brings to light two considerations for those not using 31 March year end:

- the use of overlap; and

- for partnerships, the allocation of the proportional profit at partner level.

If approved, the changes will need to be communicated to clients at an early stage to enable calculations to be prepared and systems to be put in place.

Conclusion

With HMRC taking a ten year view to the modernisation of the tax system, with the first stage being MTD, it would not be surprising if, when quarterly reporting for all entities is in place, both quarterly tax payments and a change of year end date are reconsidered.

As it stands, the first tranche of MTD cases has a predominantly 31 March year end. The UK government also uses a 31 March year end which may influence the decision should a change of date be made.

With real time reporting for capital gains, PAYE and stamp duty land tax already in place, will the change to an accounting date mean that much? If income is reported quarterly on an arising basis and taxed accordingly HMRC expects that the year end adjustments will be minor and will be reflected in a smaller balancing payment. This would then open the doors to quarterly tax payments.

The numbers are not yet available for companies, but once they are brought in to the MTD regime, it may be worth at this point reconsidering a 31 December year end by which time those already making quarterly reports with a 31 March year end will be reporting on an actual basis (or going through the ‘spreading’ option).

Should a change to a 31 December tax year end follow after MTD for corporates it would have less of a noticeable impact reducing any practical downsides.