Key points

- The hole in public finances is a long-term trend linked to age-related spending and exacerbated by the pandemic.

- The report recommends against short-term tax increases.

- Tax increases are appropriate in the longer term when combined with tax reform.

- Corporation tax will increase from 19% to 25% in 2023.

- A freeze in income tax thresholds will help raise public funds instead of tax rate increases.

- The report finds there is need for a major reform of the tax treatment of the self-employed and employees.

What should UK taxes look like in a post-pandemic world? In its 1 March Tax after Coronavirus report (tinyurl.com/y59h9hah) the Treasury Committee put forward recommendations for changes to the existing tax system to help buoy our depleted public finances as well as recommendations for future tax reform and simplification.

Opportunity for reform

The reason for launching the committee’s inquiry is, however, not exclusively due to the hole in public finances caused by the decrease in government receipts and massive increase in government spending due to the Covid-19 crisis but an ‘unsustainable long-term trajectory … due primarily to projections of rising age-related spending based on existing government commitments’. In other words, successive governments have made pledges to future generations for which nothing has been set aside – promises regarding income, healthcare, pensions, etc.

This divergence represents, the report says, ‘an ultimately greater challenge to the public finances than the pandemic’. The UK has been on this trajectory since 2011 and while there is no consensus at the level at which public debt should be stabilised, the takeaway point of the report is that ‘if public spending and revenues are not to diverge without limit, either the former must be restrained or the latter must be raised’.

The report goes on to say that if the government is going to raise taxes it also has the opportunity for a measured and thoughtful reform of the structure of the tax system.

The report therefore considers whether these ‘long-term pressures’ and the impact of Covid-19 are best addressed through tax, what level of tax the UK can endure, the areas of the tax system that are most in need of reform and whether there is a role for windfall taxes in a post-pandemic world.

Yes to tax increases but not in the short term

The UK finds itself in a paradoxical situation where, despite the fact that debt burden has gone up from around 80% of GDP to over 100% of GDP – and it is forecast to stay there for at least five years – the burden of servicing that debt has gone down. However, how long these low interest rates on public debt will stay low is anyone’s guess and the decision on when to implement that increase in taxes is, therefore, a big decision.

The report concludes, however, that if the government is to raise taxes it should do so from two to three years hence rather than six months to 18 months hence.

While expert witnesses did not fully agree on the overall taxable capacity of the UK, they agree that the UK is able to raise taxation as a share of GDP and raise additional tax revenues but, as mentioned above, an increase in taxes needs to be combined with a reform of the tax system. The need to raise revenue should also be tempered by the overarching need to support entrepreneurs and inward investment.

The major contributors

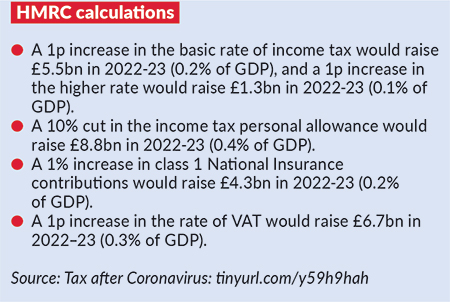

The changes that the chancellor, Rishi Sunak, announced at the spring Budget generally reflect the spirit of these committee recommendations. The Conservative government had already pledged to the ‘triple tax lock’ and therefore the rates of income tax, VAT and National Insurance contributions (NICs) were not altered in the spring Budget despite the report stating they are the ‘leading candidates for raising additional revenue’. HMRC calculations included in the report show that modest changes in those three taxes could help raise finances for the public purse (see HMRC calculations).

However, the government’s manifesto triple tax lock commitment does not preclude it from adjusting income tax thresholds and the report suggested that the government could raise revenue simply by freezing income tax thresholds causing ‘minimum economic distortion’. This is exactly the road the chancellor has taken, however the measure has come under attack with commentators calling it ‘an increase in an individual’s tax burden “by stealth”’.

The report discarded the idea of making changes to NICs whereas, with regard to VAT, expert evidence seemed to show that broadening the tax base would be more efficient than increasing the tax rate. Furthermore, VAT tax increases are the least popular, with one expert saying: ‘There is far more appetite in the country for raising more money from income tax than VAT.’

The final major revenue raiser, corporation tax, was also discussed at length. Before the pandemic, the government had intended to reduce the corporation tax rate to 17% and some of the witness evidence called into question ‘whether [increasing the corporation tax rate] would be the right thing to do, especially at a time like this when you really want to send a pro-business, pro-investment message as we come out of the pandemic’.

In line with the report’s recommendations not to raise taxes in the short term, the Budget announced that corporation tax is to rise to 25% from 19%, but not until 2023. The report is clear though that this corporation tax increase can help raise revenue without damaging growth ‘if balanced with fiscally appropriate measures to help business, such as enhanced loss relief and capital allowances’. These are measures which, again, were announced in the Budget.

Taking care of business

The government has, in the past year, introduced measures to support businesses through the pandemic but the report suggests two additional measures to help the self-employed and limited companies through the tax system.

Three-year loss carry back

The ‘loss carry back’ system is not new. In previous economic crises governments introduced a three-year loss carry back – and the report to the inquiry recommended its re-introduction for both incorporated and unincorporated businesses. The chancellor adopted this measure in the spring Budget (tinyurl.com/2sb6zvd3), possibly as a way to soften the blow of a much higher corporation tax increase than expected.

Capital allowances and the super deduction

Business investment has fallen during the pandemic and the committee’s report recommends that the annual investment allowance (AIA), which currently stands at £1m, should be extended beyond 31 December 2021 – or even retained permanently. The CIOT’s submission highlighted that in just over ten years the level of AIA has changed five times to amounts ranging from £25,000 to £500,000. Extending the AIA would provide welcome certainty to small and medium-sized enterprises.

In the event, the chancellor’s announcement did not extend the AIA beyond the end of 2021, but he announced a new ‘super deduction’ of 130% for qualifying capital expenditure (plant and machinery). This will generate a reduction in tax of 24.7p for every £1 spent, explains the ICAEW. Expenditure on special rate assets – such as hot and cold water systems and other ‘integral assets’ – will attract a 50% rate and a 9.5p tax reduction. Taxation will cover the ins and outs of the super deduction in an article in a forthcoming issue.

Aside from supporting those that have struggled in the pandemic, the inquiry also considered taxes on those businesses that have benefited from the pandemic – would introducing a so-called ‘windfall tax’ be a good way to raise revenue? And what about taxing those with the most resources?

Profit in a downturn

Expert witnesses were in disagreement as to whether introducing windfall taxes is a good idea. The Tax Justice Network fully supports a windfall tax, for example saying that 100% of the profits that large multinational companies have made in the last year ‘simply because their smaller, local competitors have been locked down’ would ‘ideally’ come back into the public purse.

There are, however downsides to a windfall tax. These include its potentially retrospective nature and complexities implementing it including identifying sectors to which it should apply, ensuring that it is fairly targeted at firms which have benefited excessively, and identifying the elements of a firm’s profits which could be attributed to excessive profits generated by the pandemic.

In essence, the report concludes that introducing a windfall tax is ‘problematic but not impossible to introduce’. Perhaps, like potential increases in capital gains tax, this is something the government will announce in future.

Much like the pandemic has not hit all businesses to the same degree, not all households have had the same experience during the pandemic and those that were already struggling have found themselves worst affected. The inquiry therefore considered whether the introduction of a wealth tax would level the playing field.

The evidence led the committee to conclude that an annual wealth tax would be difficult to deliver while not improving inequality or delivering the revenue the government seeks. There was a little more support for a one-off wealth tax which, in theory, could raise £260bn if based on a rate of 5% on net wealth over £500,000 per individual or £80bn if at a rate of 5% over £2m per individual, payable over five years. There were significant reservations that a tax imposed once can be imposed again, and that such a tax might be seen as retrospective. The committee’s report therefore did not go as far as recommending the introduction of a one-off wealth tax.

Reforming tax

The inquiry also considered expert evidence regarding which areas of the tax system most urgently need reform.

Three person problem and pensions

The report highlights that the long-term shift in burden of taxation from income tax to NICs has made alternative work structures to PAYE employment more attractive from a tax perspective and workers and employers seek to avoid PAYE costs by working as self-employed or contracting through a limited company. So the inquiry asked: ‘Should the income of the self-employed be taxed at the same rate as employees?’

The majority of views expressed that there is no apparent reason for the so-called ‘three person problem’: ‘If you have similar work, whether you are employed, self-employed or through a company …, there does not seem to be a logical reason in terms of fairness as to why those different people should pay different amounts of tax.’ And additional ‘risk’ incurred from the self-employed should not be considered a factor in this divergence as: ‘Some employees are in very risky and precarious employment. Risk is not related to the amount of tax being paid under the current system.’

The report concludes that there is a ‘long overdue’ need for a major reform of the tax treatment of the self-employed and employees as the current system is ‘confused, unfair and unsustainable’ and should look at removing the ‘three person problem’ altogether. However, in the words of an expert witness, the issue lies in bringing employees and the self-employed on an even keel as ‘the differences are so huge that to adjust them would be massively painful for self-employed people’.

If the tax advantages of the self-employed were to be reduced, the tax advantages of running a limited company should also be considered for reduction relative to the taxation of employees under PAYE, the report says.

Furthermore, when reviewing the burdens of taxation for the employed and self-employed and limited companies, the government should also review the taxation of pensions and the tax relief applicable to pension payments.

Taxing digital services

The inquiry report strongly approves of the government’s approach to the taxation of digital services. The UK currently enforces a unilateral digital services tax aimed at capturing more of the profit made in its territory by large overseas digital companies like Google, Amazon and Facebook (it is charged at 2% and has been in force since 1 April 2020).

The government’s intention is to abolish it when international agreement is reached to share the profits of these companies more fairly.

The only recommendation with this regard is for the government to update the committee annually on progress towards reaching international agreement on the taxation of digital services, the yield of the digital services tax and the effects of the tax on digital companies and the wider economy.

Capital taxes reform

Recognising that there are ‘problems’ with both inheritance tax and capital gains tax – both being subject to extensive reliefs and exemptions – the government asked the Office for Tax Simplification (OTS) to examine both taxes and make proposals for reform.

The OTS published recommendations reports for each of these taxes which, for IHT, included simplifying the lifetime gifts allowance, shortening from seven years to five years the period before death during which lifetime gifts are chargeable, and restrictions to the capital gains uplift on death.

The capital gains tax report recommendations included a closer alignment between capital gains tax rates and income tax rates, and it also called for restrictions to the capital gains uplift on death.

Many high net worth individuals will have breathed a sigh of relief when the Budget swooped over CGT without announcing a dreaded increase that had been touted for months.

While the government has yet to respond to either report, some commentators believe that the lack of mention of CGT in the spring Budget only means that reform is on the horizon – and the committee believes that there is a ‘compelling case for reform of capital taxes’. However, this is all very much speculative at the moment.

Replacing VAT and zero rates?

Now that the UK is no longer in the EU, it is free to tailor VAT to suits its needs better. It could even go further and replace it with a retail sales tax – US-style. The report suggests that there is not enough evidence to justify a move away from VAT to a sales tax, but what about changing the scope of VAT to reduced or zero rates? What is the impact of Brexit and the freedom to change the scope of VAT? Expert evidence expounds that: ‘The obvious danger is … it opens up scope for every sector of the economy to lobby for preferential VAT treatment. So far, the government have been able to say, “The EU ties our hands.” If they cannot say that lobbying pressure may grow.’ Therefore the report did not recommend significant changes to the scope of VAT.

The report does call on the government to set out principles and objectives for the VAT system now that VAT is free from EU law.

Business rates

During the pandemic the government has provided relief from business rates for struggling businesses but they may still struggle to pay business rates based on historic valuations were the relief to be lifted. The government has announced a review of business rates, which the report welcomes, while encouraging significant reforms to improve the functioning of the business rates system.

Conclusion

The committee’s report and the announcements in Rishi Sunak’s spring Budget align: while there will be no tax increases in the short term, income tax thresholds will remain unchanged. This will increase the income tax liability of many people as wages rise, causing great concern, but it will, according to the report, have the desired effect of raising substantial revenues to help refill our coffers. The future increase in corporation tax has not been welcome either but again, is supported by expert evidence and it is tempered with other reliefs as recommended. These changes in the tax system, the report says, will not be effective unless they are coupled with a thoughtful reform of income tax, capital taxes and VAT.