Issue: Vol 173, Issue 4434

7 Jan 2014The Upper Tribunal’s revised Rouse decision, following the Supreme Court ruling in Cotter, further muddies the waters of the self assessment process

Could the relatively short draft of FA 2014 be the start of a welcome trend?

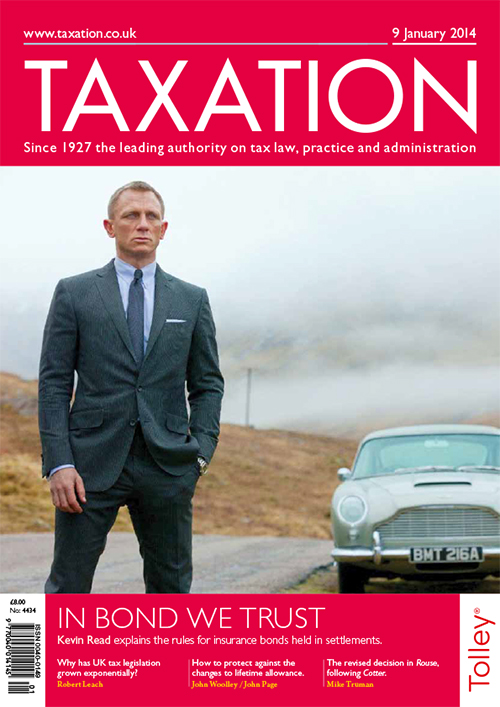

Implications of holding investment bonds in trust

Dealing with the effects of reduced pension allowances

...Tax connections; Air-con confusion

For more than 30 years, a trader let the office above his shop to a firm of solicitors and charged VAT on the rent. However, HMRC have not been notified of an option to tax the property

Does the working farmer relief apply to property transferred on the death of a husband to his wife, who was a partner in a farming business?

Advice is given on the powers of HMRC to extend an informal enquiry into a company’s affairs to the personal tax returns of a director

Download the exclusive Xero

free report here.