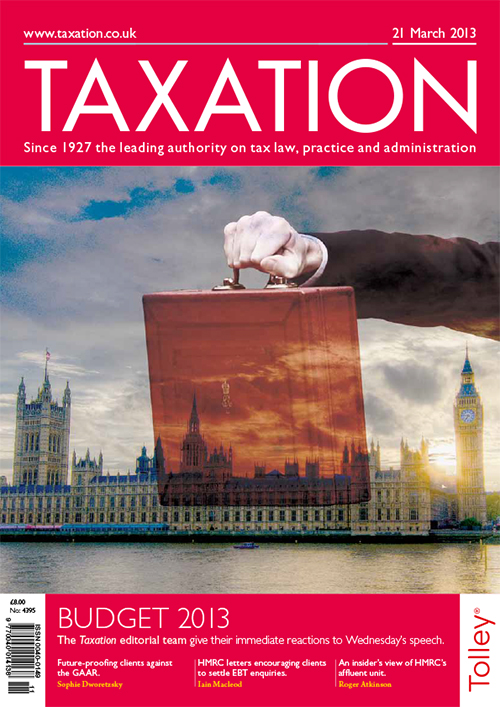

Issue: Vol 171, Issue 4395

21 Mar 2013The Taxation team offers a first reaction to the chancellor's tax measures

The Taxation team offers a first reaction to the chancellor's tax measures

Will the general anti-abuse rule provide certainty for taxpayers and advisers?

Methods used by HMRC’s affluent unit to target avoidance and evasion by wealthy individuals

Will the Revenue’s behavioural insight techniques whip taxpayers into shape?

A company purchases options to buy property and then sells these on. The company does not develop the property

A limited company intends to purchase a dog that will be used for promotional purposes. The animal will be taken home in the evenings and at weekends by one of the directors

A dormant company owns a one-quarter share in a property. The rest is owned by the company’s shareholder. The property has gained in value and the owner wishes to pass it to his children

...Pension problem; Land consultant

...ERSS bulletin; Helen Lewis; Second-hand fixtures

Download the exclusive Xero

free report here.