Issue: Vol 168, Issue 4321

9 Sep 2011

PHIL BERWICK reviews the UK-Swiss agreement, and compares it with the Liechtenstein disclosure facility

PETER VAINES on IR20 and the Gaines-Cooper case, in which he advised the taxpayer

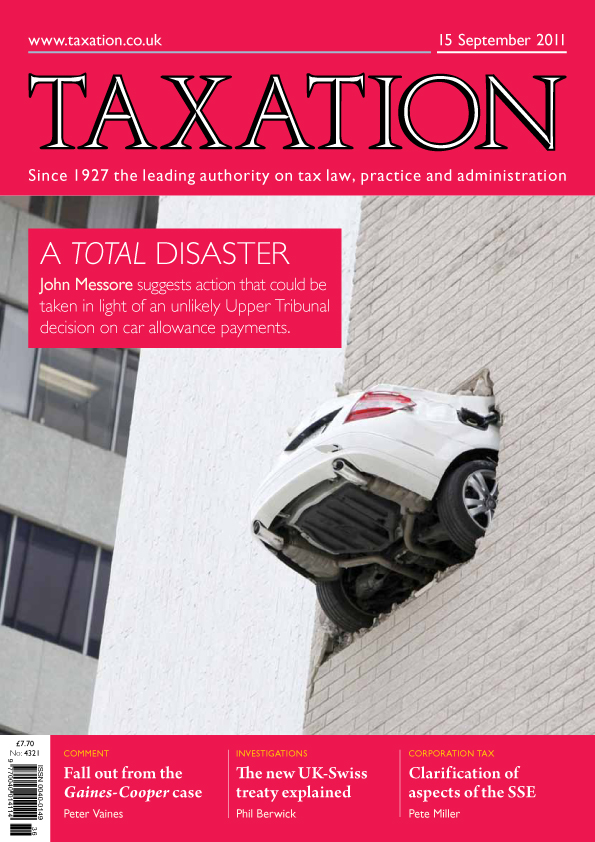

JOHN MESSORE examines the implications of an unlikely decision by the Upper Tribunal

HMRC's clarifications on the substantial shareholdings exemption are welcomed by PETE MILLER

An employee has been charged to appear before magistrates for involvement in a fight outside a nightclub. His employer is paying his legal costs

A business has ceased to trade, but there are some unpaid trade creditors who are not pursuing their debts and it seems unlikely that these will ever be paid

A new client in the solar panel installation business has taken on some sales representatives. The client pays the representatives purely on a commission basis, but also provides computers and mobile...

A supplier of mechanical equipment has sold €50,000 worth of goods to the Republic of Ireland in each of the past three years

Capital compensation; Pub talk planning; Painful P11D; Enforcement powers

Clarification for taxpayers affected by 'exceptional circumstances'

VAT initiative closes 30 September

Autumn statement; Imported antiques; Hungary DTC; VAT Notes

Revenue admits to 64-8 problems after agents' complain

Fixed fine of £100 if return misses due date

Legislation would have caused significant uncertainty

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES