Issue: Vol 176, Issue 4529

1 Dec 2015Simplifying the tax and National Insurance treatment of termination payments may hold complications for employers and employees who firmly believe in the right to exemption.

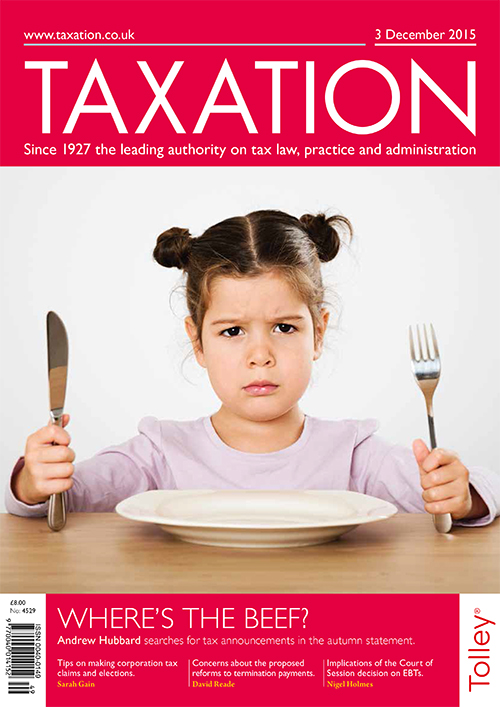

Disappointed by what was, at first sight, a lack of tax content?

The decision of the Court of Session on employment benefit trusts.

Tax returns and tax awards.

Ensuring that corporation tax claims and elections are made promptly can enhance client relationships.

Correspondence from readers on topical subjects.

Advice is required on the proceeds of life assurance received by executors.

Are swimming lessons supplied through a limited liability partnership VAT exempt?

The treatment of receipts by a company for integral features in trading premises.

The UK and Portuguese tax implications of a large gain on UK property.

Quarry question; Caravanned; Value of supply; Two residences.

Warning offshore tax evaders.

Research on the role of cash in facilitating non-compliance.

Scottish rate of income tax (SRIT) will be introduced from 6 April 2016.

Download the exclusive Xero

free report here.