Issue: Vol 174, Issue 4482

16 Dec 2014A valiant VAT adviser comes to a family’s rescue

How you can give comfort to vulnerable taxpayers on low incomes

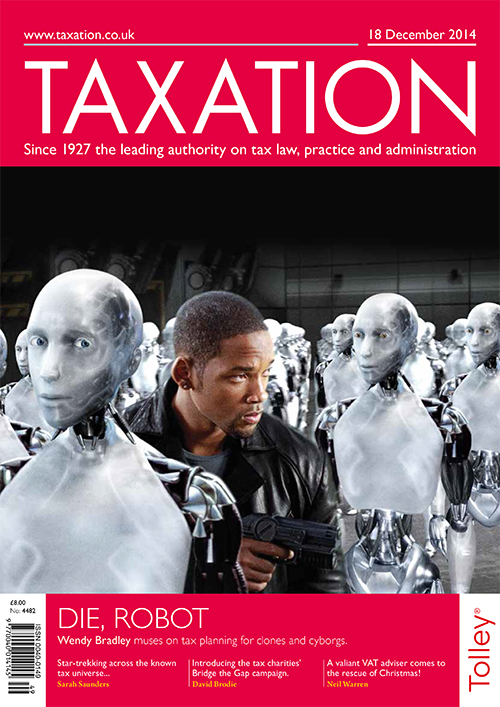

A futuristic look at the past year in tax

Reach the highest bough of retirement after a career in tax

Has a shareholder acquired control of a company through his role as a trustee?

Does a donation towards the cost of a meal mean that input VAT can be recovered?

New wheels? Company status; LFH and ER; What is a uniform?

Does a written agreement constitute a trust and therefore allow a main residence exemption claim?

Is there a VAT liability when a gallery sells art on behalf of the artist?

The government will not proceed with plans for a new employee shareholding vehicle, it has been announced.

CRC v K Donaldson, Upper Tribunal (Tax and Chancery Chamber)

Ryanair v European Commission, General Court of the European Union

G Wedgwood (TC4148)

Download the exclusive Xero

free report here.