Issue: Vol 169, Issue 4339

30 Jan 2012

MIKE TRUMAN tells the story of a failed attempt to claim a travel expenses dispensation for temporary employees

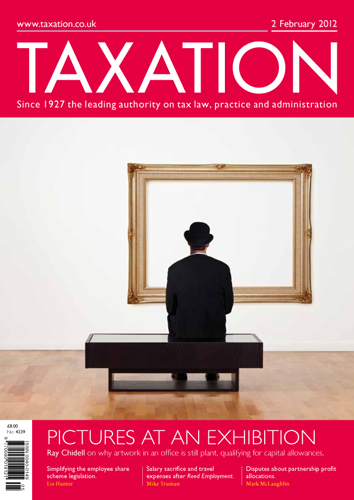

RAY CHIDELL takes a fresh look at the meaning of plant, saying artwork in offices should qualify for allowances

LIZ HUNTER explores the possible outcomes of the Office of Tax Simplification's review of share schemes

MARK MCLAUGHLIN considers the tax implications of disputes regarding partnership profit allocations and their resolution

Advice is required on the valuation of shares in a new holding company formed for a management buyout

A discretionary settlement was set up in 1999 and inheritance tax was paid on the transfer of property to it as the value was in excess of the nil-rate band. No further tax has been paid

A company buys properties to rent them out, while another buys with the aim of developing and selling them, or possibly renting if an early sale is not possible

A husband and wife live in a private residence that is owned by the husband. The property is vacated and let and the husband later transfers the property into the joint names of himself and his wife

Fowl play; Making a move; Trust trouble? The young ones

FSA abolished

Tax code changes; Online only; No tax; GAAR

Abolition of remedy for repayment leads to ECJ referral

HMRC clarifies policy on good-on-hand claims by re-registered firms

Taxpayers given two days' grace as strike on 31st looks certain

David Collis (TC1431)

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES