Issue: Vol 168, Issue 4332

24 Nov 2011Online tax filing brings benefits, says DONALD DRYSDALE, but is there a drawback to the latest programme?

How can remuneration packages be used to save tax and National Insurance? SIMON MASSEY has suggestions

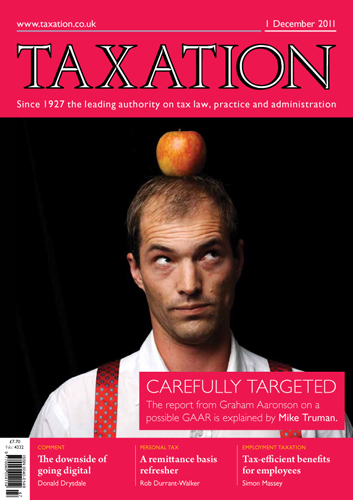

MIKE TRUMAN sets out the key points of new proposals for a general anti-avoidance rule

ROB DURRANT-WALKER serves a livener for those dealing with short-term residents

Problems can arise when a shareholder/director uses their company as a personal ‘piggy bank’

A consultant who is employed by the NHS also has private income as a self-employed surgeon and he would like to carry on this business via a limited company

A husband and wife formed a limited liability partnership to purchase a business from a sole trader. They later realised hey would prefer to trade via a limited company, and the firm was transferred

A property development business purchased a public house, with the intention of building about 20 residential units on the site. VAT was paid on the purchase, but can it be disapplied on a subsequent...

Reduced shareholding; VAT rumours; WIP it up; ER conundrum

VAT and boats; VAT and boats; New forms; Tax credits; Defining charity; Pensions news

Sent to higher and basic rate taxpayers

Issue 46 summarised

Follows HMRC review of three transitional years

More taxpayers expected to be scrutinised in shorter time

Wright and another v Gater and another, Chancery Division

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES