Issue: Vol 168, Issue 4328

31 Oct 2011

FIONA FERNIE explains the workings of the new UK-Swiss agreement on taxation

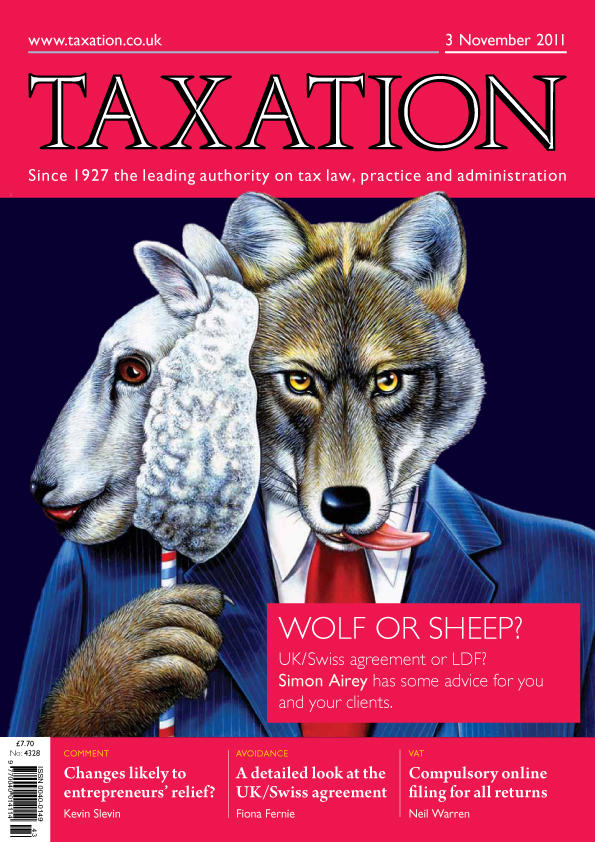

Or blessing in disguise? SIMON AIREY considers the UK-Swiss tax treaty

KEVIN SLEVIN wonders whether the ability to manufacture a lower rate with entrepreneurs’ relief may be about to end

NEIL WARREN advises on the compulsory requirement for small businesses to file VAT returns online from next year

A company’s purchase of own shares is being carried out by way of a single contract with multiple completions

An employer has, to some extent, remunerated its employees using cash withdrawn from the business. It must now pay previously unpaid PAYE liabilities

On his death in April 2010, a client’s half share of the matrimonial home passed to a discretionary trust. His widow intends to remarry and advice is given regarding the tax advantages and...

An employer provides a recreation room for employees at one of its offices, but this is not easily available to the employees at its two other offices

Desperandum; No actual sale; Three corners; Kuwait costs

Revenue & Customs Brief 37/11 issues reminder

New regulations come into force

Manual updated; Interest; IHT toolkit; JTASSG minutes

HMRC prepare second phase

President Meeson steps down as his firm faces allegations of pension misdealing

Discussion paper moots new system for 'connected employers'

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES