Issue : Vol 187, Issue 4783

8 Mar 2021

Plus ça change plus c’est la même chose

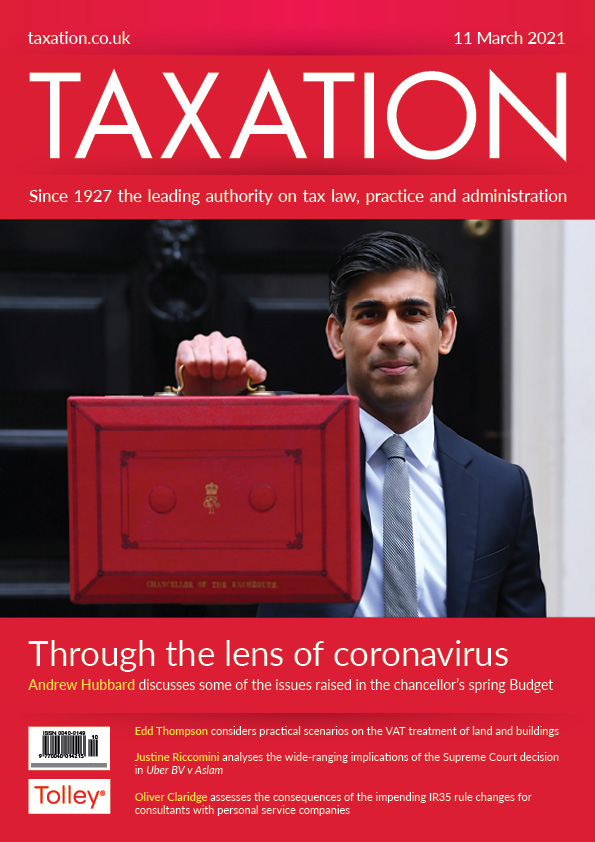

Through the lens of coronavirus

Importance of strong foundations

Taxi for Uber!

The road ahead

HMRC’s enquiry of agent in respect of client SA return.

Coffee machine used for homeworking.

Tax consequences on the transfer of business assets.

Replacement sales invoices to correct VAT errors.

Connected persons

Are these companies ‘connected’ for tax purposes?

Two companies have recently entered into a transaction, the tax treatment of which would depend on whether they are...

The chancellor has extended the coronavirus job support scheme to September 2021. The government intends to introduce an employer contribution towards the cost of unworked hours of 10% in July, 20% in...

The penalty regime for VAT and income tax self assessment is to be revamped. These reforms will come into effect for:VAT taxpayers, for periods starting on or after 1 April 2022;taxpayers in income...

Among the Budget announcements was affirmation that personal allowances would remain at their 2021-22 levels until April 2026.The income tax personal allowance will rise with the consumer price index...

The Treasury is reviewing the operation of the enterprise management incentives scheme, in particular whether it should be expanded. In a call for evidence, it is asking for views on:whether the...

A review of the research and development (R&D) tax reliefs is underway to explore the nature of private sector research and development investment in the UK, how that is supported and where...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES