Issue : Vol 184, Issue 4707

5 Aug 2019

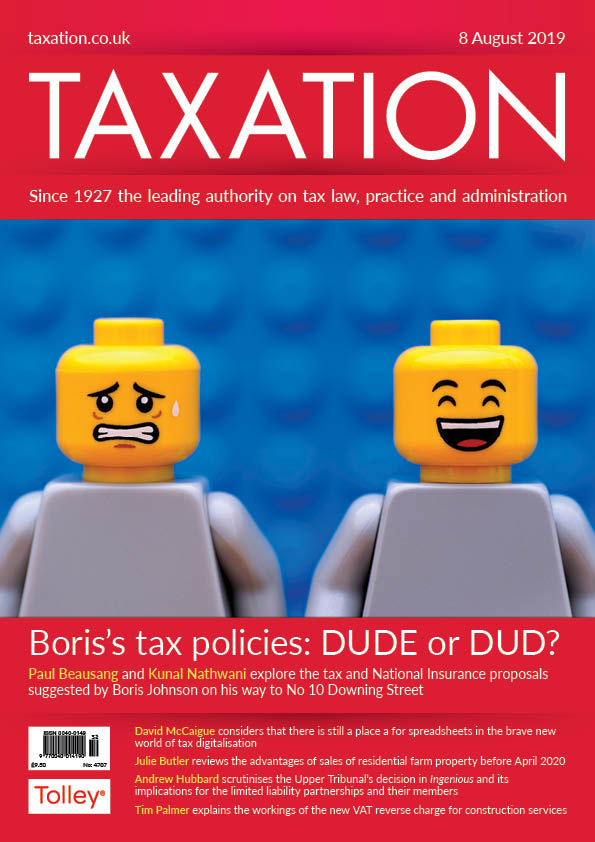

DUDE or DUD?

Saddles for unicorns?

A common definition of digital would be helpful

Property prospects

Construction upheaval

The future for spreadsheets

Reclaiming VAT on HP asset bought by director

Tax on farm which diversified into liveries

German income tax relief for property losses

Filing obligations following a group restructuring

Let's dance; exclusivity; inheritance implications; pension problem

Cross-border VATA list maintained by the EU VAT forum now contains details of 22 cross-border VAT rulings. Member states, including the UK, have been participating since June 2013 in a pilot for...

HMRC is taking a sensible, pragmatic approach in offering time-to-pay arrangements to taxpayers who applied to settle their involvement in contractor loan schemes, said the House of Commons’...

HMRC is holding talking points webinars for tax advisers:New VAT reverse charge for construction services: 21 August – midday to 1pmVAT flat rate scheme: 22 August – midday to...

The Chartered Institute of Taxation, Institute for Fiscal Studies and Institute for Government have written to the newly-appointed chancellor of the exchequer and financial secretary to the...

Show

15

READERS'

FORUM

TAX JUST GOT COMPLICATED. HERE’S HOW TO MAKE IT SIMPLE.

Download the exclusive Xero

free report here.

Download the exclusive Xero

free report here.

New queries

CASES